In recent years, the legalization of marijuana has sparked considerable controversy. While some see it as a positive development due to its perceived medical advantages and economic potential, others are wary of associated health hazards, increased availability to minors, and the risk of addiction.

Marijuana legalization across states varies significantly, with lawmakers either fully approving its use, permitting it solely for medical purposes, or enforcing penalties, including prison sentences, for its possession.

Nevertheless, despite the mounting concerns surrounding the disadvantages associated with the legalization of marijuana, as of April 2024, 38 states have legalized marijuana for medical purposes, with 24 of them also permitting it for recreational use.

With the anticipation of more states amending their laws to favor decriminalization of the substance by next year, a substantial segment of the American population aged 21 and above will likely gain access to marijuana.

Moreover, several other countries, such as Canada, Germany, Mexico, South Africa, and Thailand, have legalized marijuana. That said, the legalization of marijuana can provide a favorable regulatory environment for cannabis companies mentioned below.

Curaleaf Holdings, Inc. (CURLF)

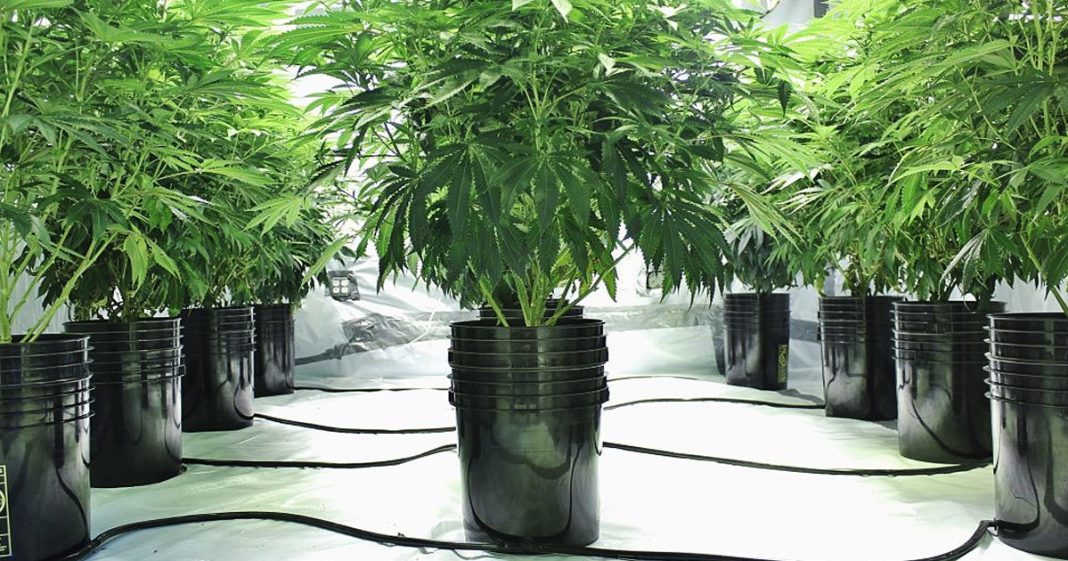

With a focus on offering high-quality cannabis products catering to diverse consumer preferences, Curaleaf Holdings, Inc. (CURLF) operates across 17 states and manages around 145 dispensaries and 21 cultivation sites.

The company emphasizes its presence in densely populated states such as Arizona, Florida, Illinois, Massachusetts, New Jersey, New York, and Pennsylvania. CURLF kicked off the year by engaging in several strategic acquisitions to expand its market presence and drive sales.

For instance, in February, CURLF’s European division announced its acquisition of Can4Med, a prominent pharmaceutical wholesaler specializing in cannabinoid medications in Poland. This strategic initiative represents a major milestone for both entities and highlights CURLF’s dedication to improving patient access to premium medical cannabis products throughout Europe.

Meanwhile, in March, CURLF agreed to acquire Northern Green Canada (NGC), a vertically integrated Canadian licensed cannabis producer. This acquisition represents another significant milestone in CURFL’s expansion strategy, particularly in Europe.

Furthermore, this acquisition enables CURLF to enhance its European margins and extend its global footprint across North America, Europe, and Australasia (Australia/New Zealand).

Besides, the company reported a modest 1.5% year-over-year increase in fourth-quarter net revenue, totaling $345.27 million. CURLF reported an adjusted gross profit of $160.40 million and an adjusted gross margin of 46%. Its adjusted EBITDA rose 24.5% from the prior year’s period to $83.01 million.

Looking ahead, analysts foresee a 1% year-over-year rise in the company’s fiscal 2024 first-quarter revenue and a 26.9% year-over-year rise in its earnings per share.

Green Thumb Industries Inc. (GTBIF)

Green Thumb Industries Inc. (GTBIF) is a national cannabis consumer goods company and retailer dedicated to promoting wellness through cannabis while contributing to local communities. The company also operates a growing network of retail cannabis stores called RISE.

GTBIF has 20 manufacturing facilities, 92 retail locations, and operations across 14 U.S. markets. With a market cap of roughly $2.94 billion, the stock has surged more than 73% over the past year.

During the fiscal 2023 fourth quarter, the company witnessed a 7.3% year-over-year topline growth, reaching $278.23 million. Its attributable net income came in at $3.22 million and $0.01 per share versus a net loss of $51.23 million and $0.22 per share in the same period last year, respectively.

While reflecting on the past year’s performance, GTBIF’s Chairman and CEO Ben Kovler highlighted the company’s record revenue and an adjusted EBITDA of $91 million. Additionally, GTBIF generated $225 million in cash flow from operations for the full year while investing over $200 million in capital expenditures to drive future growth.

Ending the year with a robust balance sheet, including $162 million in cash, the company returned a staggering $65 million to shareholders through share buybacks and debt repurchases. Furthermore, the board approved an additional $50 million for the share repurchase program, bringing the total remaining repurchase ability to nearly $60 million.

Looking ahead to 2024 and beyond, Kovler expressed optimism, citing the company’s industry-leading brands, momentum, talented team, expanding customer base, and financial flexibility as driving factors for continued success.

Wall Street analysts also appear bullish for GTBIF’s upcoming first-quarter results, predicting an 8.2% year-over-year rise in revenue and an 18.5% year-over-year surge in earnings per share.

Trulieve Cannabis Corp. (TCNNF)

With shares up roughly 102.6% year-to-date, Trulieve Cannabis Corp. (TCNNF) has emerged as a top-tier, vertically integrated cannabis company operating across multiple states in the U.S. Its strong market presence in Arizona, Florida, and Pennsylvania forms the backbone of its operations in the Northeast, Southeast, and Southwest regions.

However, the company’s final quarter of 2023 revealed a mixed picture. TCNNF’s revenue dropped 3.7% year-over-year to $287 million. It reported an adjusted net loss of $23 million and $0.12 per share, slightly improving from a net loss of $34 million and $0.18 per share in the prior-year quarter, respectively.

On the positive side, the company’s gross margin and adjusted EBITDA margin stood at 54% and 31% versus 53% and 28% in the year-ago quarter.

Despite the mixed performance, TCNNF’s CEO Kim Rivers highlighted that the company is optimally positioned to capitalize on upcoming growth catalysts buoyed by its robust cash generation and a clearly defined strategy,

For the fiscal year ending December 2023, analysts expect TCNNF’s revenue to grow 2.2% year-over-year to $1.15 billion. Similarly, the company’s revenue for the fiscal year 2025 is expected to grow 6.5% from the prior year to $1.23 billion.

Moreover, CEO Kim Rivers recently expressed gratitude for the Florida Supreme Court’s affirmative ruling on the Smart & Safe Florida initiative, which has been placed on the 2024 General Election ballot. If passed, the initiative will allow adults over 21 to purchase cannabis products for personal use, a development that could potentially strengthen the company’s financial position.

Bottom Line

As marijuana legalization policies across the U.S. and worldwide undergo significant shifts, investors have a unique opportunity to capitalize on the growth potential of the cannabis industry. Amid expanding legalization efforts, leading weed companies CURLF, GTBIF, and TCNNF could experience robust growth in the upcoming quarters.

To that end, investors could keep a close eye on these cannabis stocks for potential gains.