It felt like the end of the story. Blackstone officially acquired Hipgnosis Songs Fund from its public shareholders last month for USD $1.584 billion – giving the Merck Mercuriadis-founded company an enterprise valuation of $2.2 billion-plus.

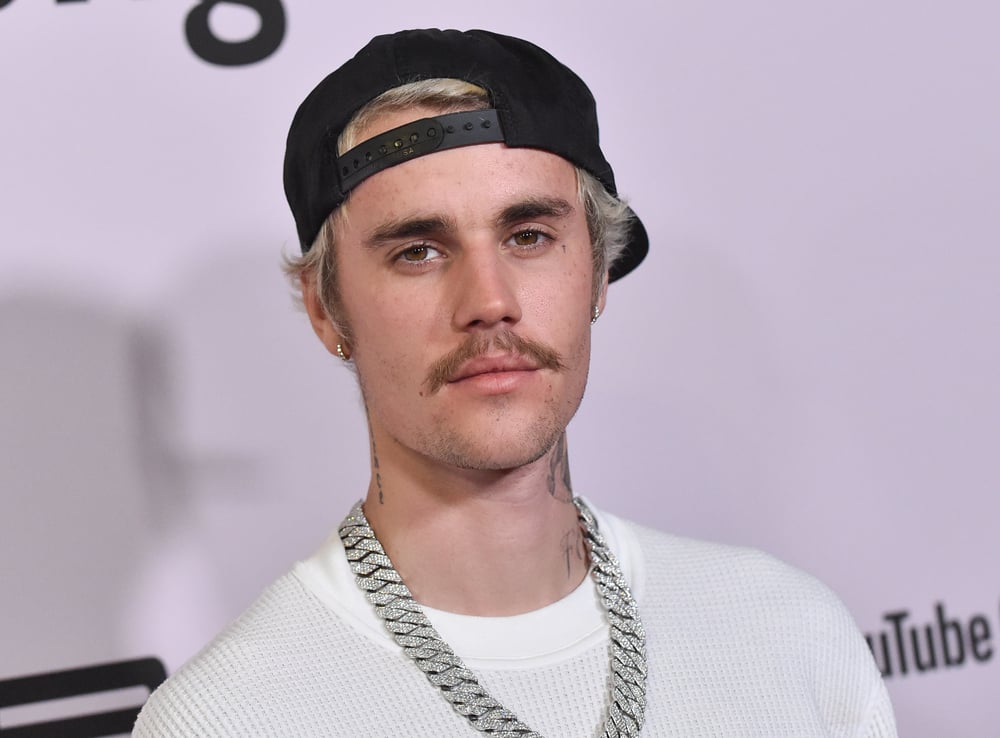

The post-acquisition plan was obvious: Blackstone would combine HSF’s 40,000 songs with Blackstone’s privately held Hipgnosis Songs Capital, aka Hipgnosis Songs Assets, home to copyrights associated with Leonard Cohen, Justin Timberlake, Justin Bieber, Nelly Furtado, and Kenny Chesney.

That Blackstone business combination, MBW understands, took mere days to happen following the HSF acquisition.

What was perhaps less clear in the wake of the Blackstone/HSF deal was what would happen to Hipgnosis Song Management (HSM) – the investment adviser to both Hipgnosis’ private fund and the (previously) public entity of Hipgnosis Songs Fund.

Chatter around HSM gathered volume when it was announced on July 2 that Mercuriadis would exit his role as Chairman of the company six years after founding it.

Despite leaving behind an experienced leadership team including Ben Katovsky (CEO), Dan Pounder (CFO), Jon Baker, and Sara Lord, Mercuriadis’ exit led some to assume that Blackstone might slim down HSM, as the financial giant looked to take a quieter role in music business rights ownership.

That assumption is now looking questionable – because Hipgnosis Song Management is on a hiring spree post-Blackstone’s HSF deal.

HSM is currently recruiting for a number of London-based roles including Product Manager of Creative/Audience Development, plus VP of Licensing Management, a Junior Data Engineer, and a Team Coordinator.

This does not appear to be the action of a company looking to minimize its team.

Another development is taking place at Hipgnosis, too, which also speaks to the company’s potential future impact in the global music space.

Whispers are breaking out amongst MBW’s sources in the US that Hipgnosis representatives have undertaken exploratory discussions with large music publishers regarding a potential publishing admin agreement.

To date, Hipgnosis has relied on its in-house administration team at Hipgnosis Songs Group (HSG) (previously known as Big Deal Music) to manage the publishing admin of its song portfolio in the United States.

However, during the bidding process for HSF, Blackstone confirmed that, following a successful acquisition, it might sell or restructure Hipgnosis Songs Group.

Could a publishing admin deal with a major music company now be on the horizon for Hipgnosis?

If so, it could be significant to the industry’s biggest players.

Hipgnosis Songs Fund generated $147.2 million in revenues in the 12 months to end of March 2023 – and that didn’t include Blackstone’s privately-held catalog of songs (including Leonard Cohen, Justin Bieber etc.).Music Business Worldwide