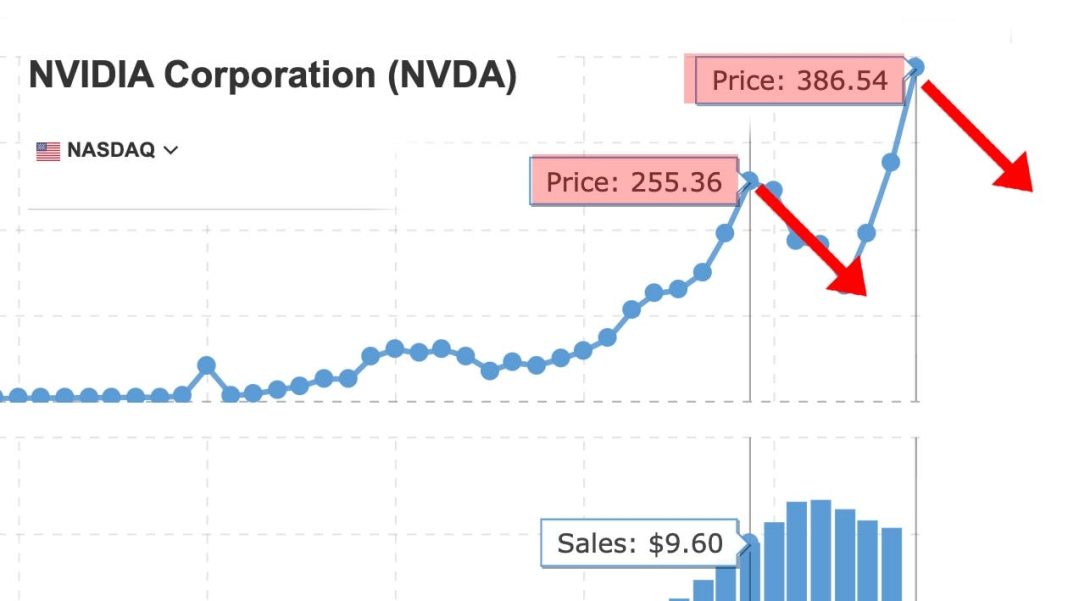

NVIDIA Corporation (NVDA) has undeniably emerged as a powerhouse in the world of chips, riding high on the wave of the Artificial Intelligence (AI) frenzy. The stock’s remarkable rally of roughly 296% over the past year, propelled by skyrocketing demand for its chips essential to train generative AI models, has fueled its trajectory.

This rapid surge positioned NVDA as the third most valuable company in the world, trailing closely behind tech titans such as Microsoft Corporation (MSFT) and Apple Inc. (AAPL).

With the entire stock market captivated by NVDA’s dramatic ascent and retail investor participation reaching unprecedented levels, Goldman Sachs analysts even went as far as to label NVDA as the “most important stock on planet Earth” ahead of its fourth-quarter earnings call.

But Why Is NVDA Deemed so Important?

In 2023, NVDA witnessed a seismic shift in its trajectory. While previously acclaimed for pioneering cutting-edge computer chip technology, particularly in enhancing graphics-heavy video games, the emergence of AI swiftly boosted these chips to newfound prominence.

The H100, crafted by NVDA, stands as a pinnacle of graphics processing unit (GPU). Tailored exclusively for AI applications, it reigns as the most potent GPU chip available. With an astonishing 80 billion transistors, six times more than its predecessor, the A100 chip, the H100 accelerates data processing to unprecedented speeds, solidifying its position as the unparalleled leader in GPU performance for AI tasks.

The H100’s exceptional performance and capacity to turbocharge AI applications have sparked significant demand, leading to a shortage of these coveted chips. On the other hand, despite the limited availability of the H100, NVDA has already unveiled its successor, the GH200.

Anticipated to surpass the H100 in power and performance, the GH200 is slated to be released by the second quarter of this year.

As the demand for innovative generative AI models soars, major tech players are entering the AI arena, designing their very own generative AI models to boost productivity. Thus, NVDA’s AI chips play a vital role in training and operating these generative AI models.

Moreover, with NVDA’s dominant hold of more than 80% of the global GPU chip market, tech giants find themselves heavily reliant on NVDA to fuel the prowess of their generative AI creations.

Despite such solid demand for NVDA’s offerings, Cathie Wood, the head of ARK Investment Management, pointed out that the GPU shortages, which surged last year alongside the increasing popularity of AI tools like ChatGPT, are now starting to ease.

She highlighted that lead times for GPUs, specifically those manufactured by NVDA, have notably reduced from around eight to 11 months to a mere three to four months. With the possibility of double and triple ordering amid widespread apprehensions about GPU shortages, Wood believes that NVDA might face the pressure of managing surplus inventories.

Consequently, Wood’s concerns over excess inventory spark a pivotal question: Is NVDA headed for a correction?

In response to the rising popularity of AI tools last year and heightened demand for its AI chips among tech companies, NVDA has tried to expand its GPU facilities, which is evident from the launch of GH200 this year.

In addition, NVIDIA’s Chief Financial Officer, Colette Kress, underscored the company’s efforts to enhance the supply of its AI GPUs, indicating a commitment to meet growing market demands.

Buoyed by its heavy dominance in the GPU market, the company posted solid fourth-quarter results, which further fueled the stock’s trajectory. Its revenue increased 265.3% year-over-year, reaching $22.10 billion. Meanwhile, the company’s bottom line hit $12.29 billion, marking a staggering growth of 769% from the prior-year quarter.

However, NVDA didn’t experience such remarkable growth in its smaller businesses. Specifically, its automotive division saw a decline of 4%, totaling $281 million in sales. Conversely, its OEM and miscellaneous business, encompassing crypto chips, demonstrated a modest 7% increase, reaching $90 million.

Barclays research analyst Sandeep Gupta anticipates that demand for AI chips will stabilize once the initial training phase concludes. Gupta emphasizes that during the inference stage, computational requirements are lower compared to training, indicating that high-performance personal computers and smartphones could potentially meet the needs of local inference tasks.

As a result, this situation might diminish the necessity for NVDA to expand its GPU facilities further. With that being said, Wood’s observation about the potential for a correction in NVDA was validated when its shares plummeted last week after a robust year-to-date rally.

In addition, Wall Street analysts are ringing the caution bells as the stock reaches dizzying heights, suggesting that the AI market darling could face headwinds ahead, with expectations of slowing growth and fiercer competition.

Bottom Line

NVDA has solidified its position as a dominant player in the chip industry, primarily driven by the surge in demand for its AI chips. The company’s remarkable growth has been propelled by its cutting-edge technology and market leadership, positioning it as one of the most valuable companies globally.

However, the company’s heavy reliance on AI chip demand poses a potential risk, as any fluctuations or slowdowns in the AI market could significantly impact NVDA’s profitability and growth prospects.

Furthermore, NVDA’s shares are trading at a much higher valuation than industry norms. For instance, in terms of forward Price/Sales, NVDA is trading at 20.23x, 590.8% higher than the industry average of 2.93x. Likewise, NVDA’s forward Price/Book ratio of 25.89 is 493.7% higher than the 4.36x industry average.

The stock’s alarming valuation compared to its industry peers indicates investor confidence in NVDA’s future growth potential, leading it to be willing to pay a premium price for its shares.

However, it also signals that NVDA’s anticipated growth might already be factored into its stock price, potentially dimming its attractiveness. With analysts projecting AI chip demand to stabilize, investors might be overly optimistic about NVDA’s future growth potential.

Moreover, Cathie Wood’s concerns regarding a potential correction in NVIDIA were recently validated by a significant drop in the company’s shares last week. The chipmaker closed more than 5% lower last week, marking its most challenging session since last May.

However, despite these uncertainties, NVDA’s growth potential may not have reached its peak yet, given the company’s ability to maintain its dominant position even in the face of stiff competition in the chip space. Therefore, adopting an entirely bearish outlook on the company’s shares might not be prudent.

Instead, investors could consider holding onto their positions, as there may still be opportunities for gains in the future.