In July, investment giant Blackstone acquired Hipgnosis Songs Fund‘s assets from HSF’s then-public shareholders in a transaction worth USD $1.584 billion.

According to MBW’s analysis, that transaction – when you factor in HSF’s debt – gave HSF’s portfolio of 45,000 songs an approximate enterprise value of USD $2.20 billion.

That same portfolio (originally accumulated between 2018 and 2021 by ex-Hipgnosis boss Merck Mercuriadis) has just been re-valued, courtesy of a new report from Kroll Bond Rating Agency.

And guess what? It not only suggests that the songs acquired by Mercuriadis at HSF have significantly grown in value – it also suggests that Blackstone got a bit of a bargain when it bought them.

Kroll’s report cites an unnamed independent third-party valuation firm that valued the HSF portfolio at USD $2.36 billion as of August 1, 2024.

That’s around $150 million more than the total amount HSF spent buying its portfolio over the years ($2.206 billion, according to financial documents).

It’s also around $150 million more than the portfolio’s estimated enterprise value of $2.20 billion when Blackstone acquired it this summer.

Kroll’s newly-published valuation of the HSF assets appears within a report confirming that the 45,000 songs contained within the “legacy” HSF catalog are being used to collateralize an Asset-Backed Securities (ABS) transaction (i.e. bond offering).

That ABS transaction, referred to as Lyra Music Assets (Delaware) L.P, will see Blackstone raise $1.474 billion in debt financing.

The new valuation of the HSF assets, says Kroll, was made using a discount rate of 8.25% and a discounted cash flow method based on cash flow forecasts.

The Kroll report notes that the $2.36 billion valuation does not give any credit to revenue generated by name, image, and likeness rights.

“The Valuation Agent has valued the Catalog at $2.36 billion… [its] approach is the prevailing industry convention for valuing comparable assets.”

Kroll report on Hipgnosis Songs Fund assets, now owned by Blackstone

Explaining the unnamed valuer’s methodology, Kroll wrote: “The Valuation Agent has valued the Catalog at $2.36 billion… The Valuation Agent used the income approach and assumed a discounted net present value of projected long-term free cash flow of 8.50% for the Catalog.

“This approach is the prevailing industry convention for valuing comparable assets. The Valuation Agent developed long term projections for the Catalog over a projection period of approximately 40 years, and then estimated the cash flows beyond the projection period based upon certain assumptions regarding projected financial performance utilizing terminal growth and decay rates.”

Kroll added: “The Valuation Agent has applied various long-term growth and decay rates to each asset within the Catalog, reflecting their views of the industry and the performance of each individual songwriter. The average growth rate for the valuation was determined to be approximately 2.00%.”

The valuation published in Kroll’s report is hundreds of millions of dollars higher than a recent valuation of HSF’s assets by Shot Tower Capital, which had a midpoint of $1.95 billion (based on HSF’s performance as of the end of September 2023).

Shot Tower’s valuation was based on a discount rate of 9.25%. (In basic terms, applying higher discount rates results in lower valuations, and vice-versa.)

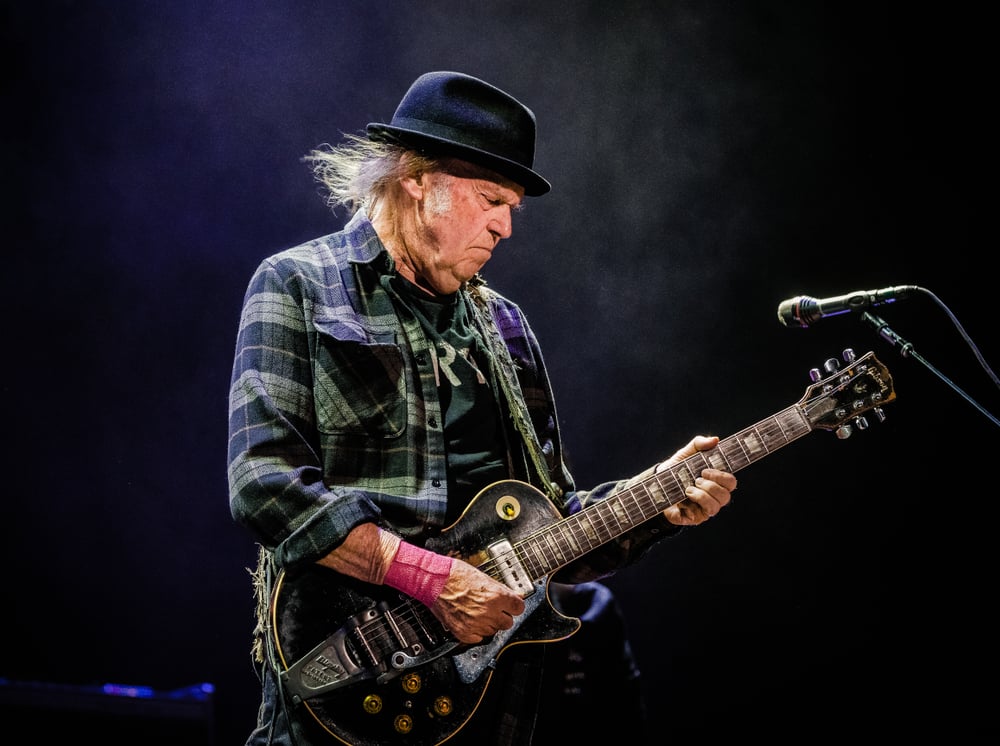

Lyra Music Assets is Hipgnosis Songs Assets’ second music royalty securitization, and will be collateralized by royalties from what it calls “the legacy SONG portfolio”, which includes content from artists and songwriters including Red Hot Chili Peppers, Neil Young, Journey, The Chainsmokers, and Shakira.

According to Kroll’s report, proceeds from the transaction will be used to fund “reserve accounts, pay certain transaction expenses, repay existing indebtedness, and for other general corporate purposes”.

Back in 2022, a previous pre-sale report from Kroll confirmed that Hipgnosis was in the process of launching a music royalty-backed bond package – a $221.65 million securitized offering.

KBRA confirmed at the time that the offering, dubbed MUSIC 2022-1, “will be collateralized by royalties from a music catalog of premium content from over 950 songs across five sub-catalogs from top artists and songwriters, including Justin Timberlake, Nelly Furtado, and Leonard Cohen”.

Rights-backed securitization is becoming an increasingly common way for music companies to raise money.

Just two weeks ago, it was also revealed via Kroll Bond Rating Agency report that Concord recently raised $850 million in debt financing through a private securitization backed by its catalog of music rights.

That same report revealed that $217.3 million was used to acquire the catalog of a mystery Latin Music superstar which turned out to be Daddy Yankee.

Concord’s $850 million ABS transaction, referred to by Kroll as the issuance of the Series 2024-1 Notes, marked the third series of Notes issued as part of a broader $2.6 billion bond offering backed by music rights from Concord’s catalog.

Elsewhere in the music industry, in March, Kobalt confirmed the raise of $266.5 million via its first-ever Asset-Backed Securitization (ABS) transaction, backed by music royalties from a catalog of more than 5,000 works from 66 writers.

Also in March, HarbourView Equity Partners secured approximately $500 million in debt financing through a private securitization backed by its catalog of music royalties.

In 2022, SESAC Music Group also closed a reported $335 million bond transaction.

Bonds act a bit like loans, but with a group of investors handing a company money, rather than said company raising that money via bank debt.

When everything goes well, these investors then make their money back (plus interest) via income over a number of years generated by an underlying asset.

To raise investor interest and confidence in bond offerings, bonds are ‘rated’ by financial institutions. Bond sellers are typically looking for an ‘A’ rating or above; a much lower rating will result in something being labelled a ‘junk’ bond.Music Business Worldwide